Does Medicare Cover In-Home Care? Discover What You Need to Know!

Understanding In-Home Care Coverage, Costs, and Options

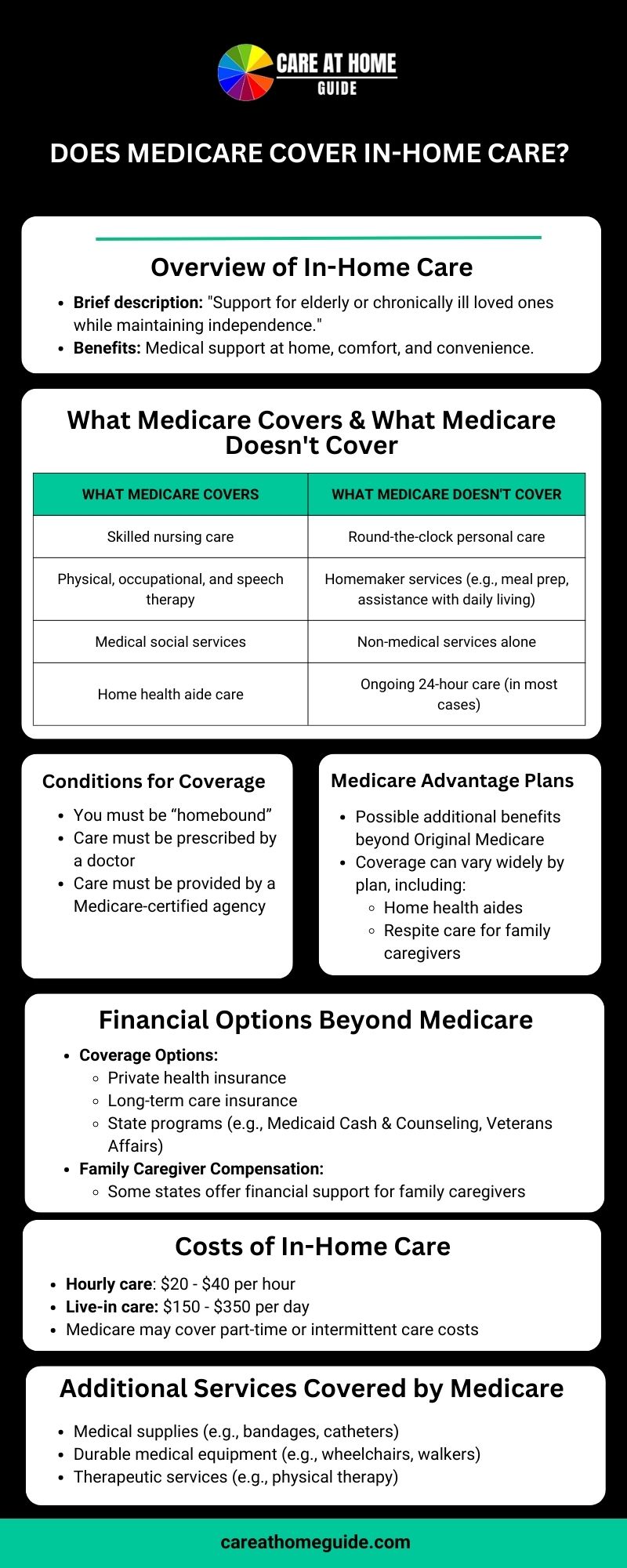

Taking care of aged parents at home or supporting loved ones with chronic illnesses can be challenging, but in-home care offers a solution that helps maintain independence while ensuring medical support. Many families rely on Medicare to cover these essential services, but understanding what Medicare does and doesn’t pay for is crucial for planning.

Medicare In-Home Care Coverage: What Is Included?

Medicare does provide some coverage for in-home care, but it is essential to understand the limitations. Part A and Part B of Medicare offer benefits for home health care, but only under specific conditions. Medicare covers services that are medically necessary for treating an illness or injury. These services can include:

- Skilled nursing care

- Physical therapy, speech-language pathology, and occupational therapy

- Medical social services

- Home health aide care

However, there are some conditions to qualify for these benefits. The person receiving care must be considered “homebound,” meaning they have difficulty leaving their home without assistance due to a medical condition. Additionally, care must be prescribed by a doctor and provided through a Medicare-certified home health agency.

What Medicare Doesn’t Cover

While Medicare offers support for medical home health care services, there are limitations. Many families find themselves wondering, “Does Medicare pay for in-home care?” While Medicare covers skilled care, it does not pay for round-the-clock personal care or homemaker services, such as meal preparation or assistance with activities of daily living (e.g., dressing, bathing) unless these are paired with medical care.

Additionally, Medicare hospice care is available for individuals who are terminally ill, offering comfort care and support during their last months of life. However, Medicare does not cover non-medical services alone or ongoing 24-hour care in most cases.

Medicare Advantage and In-Home Care

For those enrolled in Medicare Advantage (Part C) plans, there may be extra benefits beyond what Original Medicare (Part A and Part B) covers. Some plans offer broader coverage for in-home care, including home health aides or respite care for family caregivers. Check with your plan provider to understand the specific benefits and eligibility requirements, as in-home care coverage can vary greatly from plan to plan.

What Happens When Medicare Stops Paying for Nursing Home Care?

Another concern for families is what happens when Medicare stops paying for nursing home or skilled nursing care. Medicare Part A typically covers up to 100 days of care in a skilled nursing facility. After this period, Medicare coverage ends unless the patient has a new qualifying hospital stay. Families then need to seek alternative payment options. These may include out-of-pocket expenses, long-term care insurance, or Medicaid if the individual qualifies.

For those facing these financial challenges, exploring home health care can be a more affordable option than long-term nursing home care, though it is still important to understand in-home care costs and how it will be paid for once Medicare coverage ends.

Paying for In-Home Care: What Are Your Options?

Aside from Medicare, there are several options for covering in-home care costs. Families may wonder, “What insurance covers in-home care?” Beyond Medicare, some private health insurance policies and long-term care insurance plans provide coverage for home care services. However, coverage can vary significantly, and it’s important to thoroughly review your insurance options.

For individuals caring for aged parents at home, some states offer programs that compensate family caregivers. Though Medicare typically does not pay family members, programs like Medicaid’s Cash & Counseling or Veterans Affairs benefits may offer payment options. Eligibility varies, so it’s important to check specific requirements.

How Much Does In-Home Care Cost?

The cost of in-home care depends on the level of care required and the region where services are provided. For part-time or intermittent care, such as weekly visits from a nurse or therapist, Medicare home health services may cover most, if not all, of the expenses. However, for non-medical services or full-time care, families may need to explore other options.

- Hourly in-home care costs can range between $20 and $40 per hour, depending on the provider and location.

- The cost of live-in care is higher and can range from $150 to $350 per day, with additional expenses for overnight or 24-hour support.

Families should carefully weigh the costs and explore all available options to create a plan that meets their loved one’s needs while staying within budget.

Understanding the Medicare Homebound Rule

To qualify for Medicare home health benefits, the person receiving care must meet the Medicare homebound rule. This means they cannot leave their home without help, or leaving home is not advised due to their condition. This includes individuals recovering from surgery, those with chronic illnesses like Alzheimer’s or Parkinson’s disease, or those with disabilities that limit mobility.

Additional Services Covered by Medicare

Medicare not only covers skilled nursing care but also includes specific services that can be crucial to individuals or those with chronic conditions. These include:

- Medical supplies such as bandages and catheters

- Durable medical equipment (DME), including wheelchairs and walkers

- Therapeutic services, like physical or occupational therapy

These services can make a significant difference in maintaining a patient’s independence at home while ensuring that medical needs are properly managed.

Conclusion: Making the Most of Medicare In-Home Care Benefits

Navigating Medicare’s benefits can be challenging. Understanding what is covered—and what isn’t—is essential for families aiming to provide the best care. Medicare home care benefits can offer vital medical support. However, families must also explore additional resources for non-medical care and personal assistance. Whether you are caring for older parents at home or seeking professional help, knowing your options will enable you to make informed decisions about your loved one’s care.

Families can create a well-rounded care plan by considering Medicare Advantage plans, long-term care insurance, or state assistance programs. These options support their loved one’s health and well-being while managing costs effectively.